pet medical insurance wellness plans decoded

Short take: wellness pays for the routine; accident/illness pays for the unexpected. They're different tools.

Myths vs facts

- Myth: Wellness plans cover surgeries and emergencies.

- Fact: They usually reimburse checkups, vaccines, tests, and preventives. Emergency care belongs to accident/illness policies.

- Myth: If I have wellness, I don't need savings.

- Fact: Caps exist. You still want a cushion.

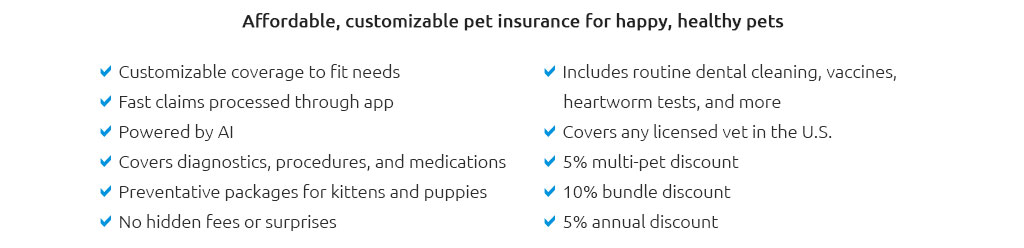

- Myth: All plans include dental cleanings.

- Fact: Some do, many don't, and some only partly. Read the item list, not the brochure headline.

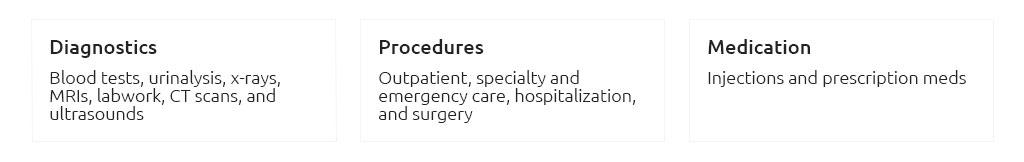

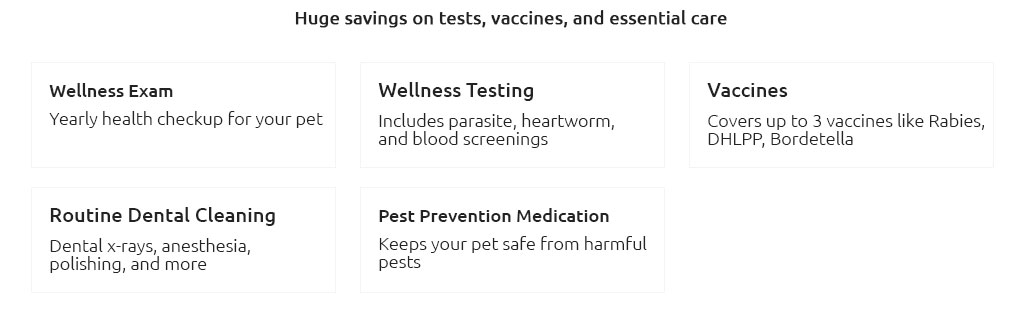

What they typically include

- Annual or biannual exams

- Core vaccines and boosters

- Fecal, heartworm, and sometimes tick-borne disease tests

- Spay/neuter or microchip (occasionally, as higher-tier items)

- Flea/tick and heartworm preventives (up to a limit)

- Nail trims or anal gland expressions (varies)

Awareness check: wellness = predictable care. Accident/illness = unpredictable care. You can carry one, the other, or both. Match to your pet's life.

Usability: make it easy

- Confirm eligible items before the visit. Screenshots help.

- Keep detailed invoices with line items and dates.

- Submit through the app the same day. Faster in, faster out.

- Watch annual caps and per-item limits. Pace refills accordingly.

- Note renewals; allowances usually reset yearly, not monthly.

Real-world moment

Saturday vaccine clinic. Quick exam, a fecal test, one booster. Receipt in hand, I snap a photo in the insurer app. A quiet ping: pending credit for the test and part of the booster. Not dramatic, just tidy. Less friction, more routine done.

Costs and value, briefly

Restraint pays off. If the plan's annual reimbursements roughly meet or beat its fee - and you'd do the care anyway - it can be worth it. If not, a simple savings line item may win.

- Look for: total annual allowance, per-item caps, waiting periods, and whether unused benefits roll over (they rarely do).

- Discount vs reimbursement: some plans reduce costs at partner clinics; others repay you after.

- Network rules: open networks are easier if you move or travel.

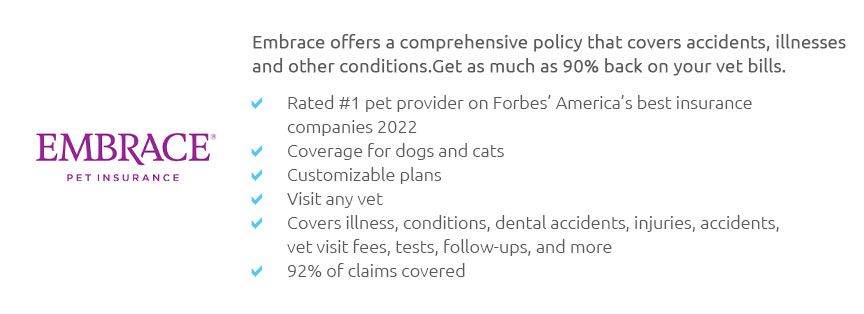

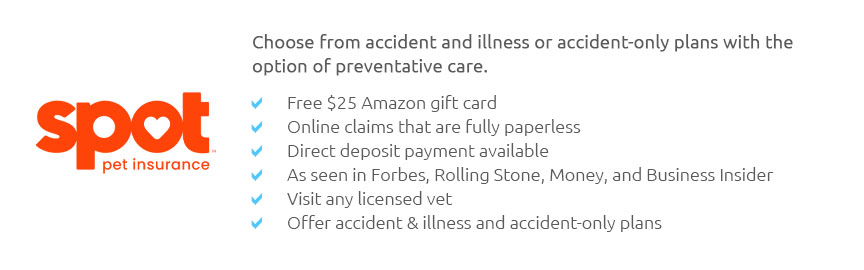

Choosing without overwhelm

Skim the benefit schedule, not the ad copy. Compare what you already buy each year to the plan's line items. If you're undecided, start with the basics and upgrade only if you consistently hit the caps.

Good fit signals

- Your pet gets routine care like clockwork.

- You prefer predictable monthly budgeting.

- You want nudges to stay current on preventives.

Maybe skip or wait

- You already bundle routine care affordably at a low-cost clinic.

- Your vet offers an in-house wellness bundle you like more.

- You're between life changes (move, new vet) and want clarity first.

Ease-of-use tips from the trenches

- One receipt per visit keeps claims clean.

- Label recurring items (e.g., "6-pack heartworm, April").

- Set a calendar reminder a month before renewals to plan remaining benefits.

Bottom line: wellness plans are practical when they match your pet's routine and your habits. Not magic. Useful. Quietly optimistic, with eyes open.